Debt Payoff Calculator – Credit Card & Loan Payoff Tool

Calculate your debt-free date and total interest costs

This debt payoff calculator shows exactly how long it will take to pay off your credit card and how much interest you’ll pay. Use this credit card interest calculator to compare minimum payments versus paying extra each month. Enter your current balance, APR, and monthly payment to see your personalized debt-free date and create a realistic payoff plan. Whether you’re using the debt snowball method or just trying to understand your payment options, this free credit card payoff calculator gives you the clarity you need to become debt-free.

Whether you need a credit card payoff calculator for one card or want to calculate payoff timelines for multiple debts, this free debt payoff calculator helps you create a realistic plan to become debt-free. Compare minimum payment scenarios, see how extra payments accelerate your debt-free date, and understand exactly where every dollar goes.

How Credit Card Interest Works

- Daily Interest: Credit cards calculate interest daily based on your average daily balance

- Monthly Compounding: Interest gets added to your balance monthly, then you pay interest on that interest

- APR to Monthly Rate: Your 18% APR equals 1.5% interest per month

- Minimum Payment Trap: If you only pay minimums, 60-80% goes to interest, not your actual debt

How Long Will It Take to Pay Off My Credit Card?

The time to pay off credit card debt depends on three critical factors: your current balance, your interest rate (APR), and how much you pay each month. This credit card payment calculator uses the standard amortization formula that banks use to show you exactly when you’ll be debt-free.

Real Examples of Credit Card Payoff Timelines

Understanding how long it takes to pay off credit cards becomes clearer with real examples:

$5,000 balance at 18% APR:

Paying $150/month = 44 months (nearly 4 years)

Paying $250/month = 24 months (2 years) — saves $1,100 in interest

$10,000 balance at 21% APR:

Paying minimum (2%) = 15+ years, $14,000+ in interest

Paying $300/month = 45 months, $3,500 in interest

$3,000 balance at 24% APR:

Paying $100/month = 42 months, $1,200 in interest

Paying $150/month = 24 months, $650 in interest

Why Minimum Payments Keep You Trapped

Minimum payments (typically 2-3% of your balance) are designed to maximize bank profits, not help you get out of debt. Most of your payment goes to interest, not principal. Your balance decreases very slowly, sometimes less than $20 per month. You can end up paying 2-3 times your original balance in total interest, and payoff can take 10-20 years for moderate balances. This debt payoff calculator shows you exactly how much time and money minimum payments will cost you.

Understanding Credit Card Interest Costs

This credit card interest calculator breaks down exactly where your money goes each month. Understanding the interest vs principal split is crucial for making smart payment decisions and achieving your debt-free goals.

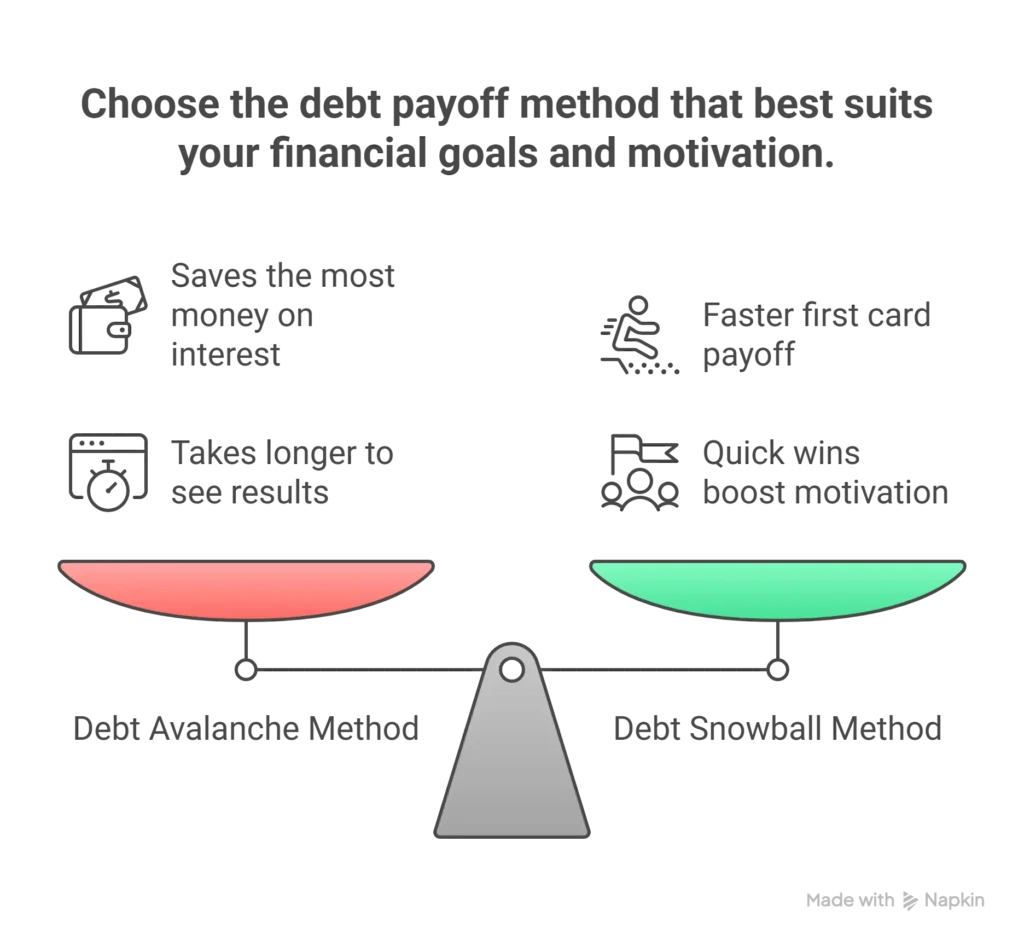

Debt Payoff Strategies: Snowball vs Avalanche

If you have multiple credit cards, choosing the right debt payoff method can save you thousands of dollars and keep you motivated throughout the journey to becoming debt-free.

🔥 Debt Avalanche Method (Math Winner)

The Avalanche method is for those who want to pay the least amount of interest possible. You pay the minimum on all accounts but throw every extra dollar at the debt with the highest interest rate first.

Why it wins in 2026:

- ✅ Saves the most money: By killing high-interest debt first (like credit cards at 24% APR), you stop the “compounding interest” trap.

- ✅ Shortens your timeline: You actually become debt-free months faster than other methods.

- ⚠️ The Challenge: It requires “inner discipline.” It might take 4-6 months before you see the first balance hit zero, which can be discouraging for some.

⛄ Debt Snowball Method (Psychology Winner)

Pay minimum on all cards, put extra toward the smallest balance first.

- Best for: Quick wins and staying motivated

- ⚠ Challenge: May pay slightly more total interest

Which Method Should You Choose?

- Choose Avalanche if: You’re analytical, disciplined, and motivated by numbers. The interest savings are significant if you have cards with very different APRs (like 12% vs 24%).

- Choose Snowball if: You need psychological wins to stay motivated. Seeing a card hit $0 quickly provides emotional fuel. Most people succeed better with this method even though it costs slightly more. Use this debt payoff calculator to model both scenarios and see which works better for your situation.

Who Uses This Debt Payoff Calculator

✅ People Stuck Paying Minimum Payments

If you’ve been paying the minimum for months and your balance barely budges, this debt payoff calculator reveals why. You’ll see exactly how much of your payment disappears into interest and what it takes to actually make progress toward being debt-free.

✅ Recent Graduates Managing Multiple Cards

Fresh out of college with 3-5 credit cards and no clear strategy? Use this credit card payoff calculator for each card separately, then decide whether to use the debt snowball or avalanche method. Having a concrete payoff timeline makes the debt feel manageable instead of overwhelming.

✅ Families Planning Major Purchases

Want to buy a house or car but need to pay off credit card debt first? This calculator helps you create a realistic timeline and see if paying an extra $100-200/month can speed up your goals by 6-12 months. Lenders look at your debt-to-income ratio, so clearing credit cards matters.

✅ People Considering Balance Transfers

Thinking about a 0% APR balance transfer offer? Use this credit card interest calculator to compare your current payoff plan against what you could accomplish with zero interest for 12-18 months. The difference can be thousands of dollars in interest savings.

✅ Anyone Dealing with High-Interest Debt

If your APR is 18%, 22%, or even higher, you need to see these numbers in black and white. This credit card payoff calculator shows the true cost of carrying that balance and motivates you to find extra money in your budget or negotiate a lower rate.

✅ People Comparing Themselves to Family Success

When relatives are buying houses and you’re stuck with credit card debt, it feels isolating and shameful. This calculator gives you a concrete path forward instead of just frustration. Seeing your debt-free date makes it feel achievable.

Common Credit Card Debt Problems This Calculator Solves

Problem: “I pay $100 every month but my balance never goes down”

Solution: See the exact interest vs principal split — you’ll understand why high APRs trap you

Problem: “How much faster will I be debt-free if I pay an extra $50?”

Solution: Compare side-by-side to see months saved and interest avoided — often dramatic differences

Problem: “I have no idea when I’ll finally be done with this debt”

Solution: Get your exact debt-free date based on your current payment plan — turns anxiety into a goal

Problem: “Is paying minimum really that bad?”

Solution: See the shocking total interest cost — often 2-3x your original balance

Problem: “Should I pay off debt or save for emergencies first?”

Solution: Calculate what your debt actually costs per month — helps you make informed tradeoff decisions

Problem: “I’m overwhelmed and don’t know where to start”

Solution: Simple inputs, clear results, actionable next steps — breaks paralysis into progress

Why You Can Trust This Calculator

- Uses industry-standard debt amortization formula

- No data stored or tracked (runs entirely in your browser)

- No signup, email, or personal information required

- Works on all devices (mobile, tablet, desktop)

- Fast and lightweight (no bloated code or ads)

- Free forever (no hidden fees, paywalls, or upsells)

- Regularly updated and maintained

Disclaimer: This credit card payoff calculator provides estimates for educational purposes. Actual payoff may vary based on your card’s specific terms, late fees, and payment processing. Always refer to your credit card statement for official information. This is not financial advice.

Frequently Asked Questions

Related Tools & Resources

GoldenToolHub Home

Explore more free calculators and tools for construction, finance, and productivity projects.

Calculate Percentage Difference

Track your debt reduction progress by calculating percentage changes in your balance over time.

Best Free Word Counter Tools

Need help writing your debt payoff plan or budgeting documents? Use our free word counter tools.

💡 Tip: Combine this debt payoff calculator with our percentage calculator to track your debt reduction progress month-by-month.